The Great Pause Week 97: BitCoinomics in Kazakhstan

A golden shanyrak set against a sky blue background with rays of the sun bouncing off two gold-winged unicorns.

Is it a coincidence that cryptocurrencies around the world have added a largely unseen, largely under-reported 7 percent to global money supply while the inflation rate in the United States—highest since the Reagan Recession in 1982—is 7 percent?

A few years ago the Ecovillage Training Center in Tennessee received an application for our apprenticeship program from a young man from Kazakhstan. I had not much prior knowledge of the region and had not recruited him, but somehow he’d got wind of our programs in permaculture and natural building and applied, so we worked out the visa and got him to Tennessee. When he showed us his photos and videos of his home town of Almaty we could see Kazakhstan was already a pretty good ecovillage incubator, with dozens of experimental neighborhoods, some entering their second decade. While their building vernacular was nothing special—cement cube apartments—the interiors revealed artistic skill and craft.

Kazakhstan is not a country most USAnians think about—just some desert country between China and Russia inhabited by nomadic descendants of the Mongols. The national emblem, adopted in 1992 to replace a Soviet badge from 1920, is a golden shanyrak (the center of the ceiling of a yurt we call the “Eye of Heaven”), set against a sky blue background with rays of the sun bouncing off two gold-winged unicorns. So, yeah, yurts and horses.

With an area equivalent in size to Western Europe (1,000,000 sq mi), Kazakhstan is the largest landlocked country in the world. With only 18 million people, it is also the least densely settled in the world. It has the second largest uranium, chromium, lead, and zinc reserves, the third largest manganese reserves, the fifth largest copper reserves, and ranks in the top ten for coal, iron and gold. It is also an exporter of diamonds. Under its southwestern Caspian lowlands is the world’s 11th largest proven reserve of petroleum and natural gas. Production had been hitting 1.6 million barrels per day (b/d) in recent months. Chevron has a 50% stake in the Tengizchevroil (TCO) field that gets oil to sea by train, about 700,000 b/d. Picture hundreds of tank cars pulled by a string of Temir Zholy 2TE10U diesel locomotives. This oil and mineral wealth have made Kazakhs some of the wealthiest people in Eurasia, which explains why its youth are constructing ecovillages in Almaty and launching start-ups on the Internet to sell stuff to China, Russia and the West. Baikonur Cosmodrome is the world's oldest and largest operational spaceport.

Earlier this month all that came to a screeching halt.

To be fair, internal conflict has been simmering in Kazakhstan for decades. There is an old Soviet era conservative element and a younger entrepreneurial, even libertarian, underclass. Kazakhstan reluctantly became the last Soviet republic to declare independence, and then only after the August 1991 aborted coup attempt in Moscow. Ten days after Kazakhstan withdrew its membership from the USSR, the Soviet Union ceased to exist.

Nursultan Nazarbayev had been a happy Soviet puppet. In 1991 he became the new country's first President. He converted the economy to capitalism by cutting deals with Chevron and other majors, dealing himself in on every contract while political and social liberalization lagged. Strikes and protests plagued his rule—oil workers in Zhanaozen, Aktau, Aktobe and Atyrau, coal miners in Karaganda, copper workers in Zhezkazgan, as well as young, liberal activists in modernistic Almaty. Their one unifying message, coined by the feminists, was “Shal, ket!” – “Old man, get out!”

By 2006, Kazakhstan was generating 60% of the GDP of Central Asia. In 1997, Nazarbayev moved his throne to a splendiferous new seat in Astana. Finally, in 2019, he stepped aside after 35 years of unelected rule. He remained as head of the national security forces and the national oil and mining companies, created a national holiday on his birthday, and renamed Astana, Nur-Sultan, after himself. He owns an estimated 330 million pounds sterling in London real estate.

Nur Sultan

President Qaysm Joomart Tokaev has been trying to demonstrate a new Kazakh model of progressive independence, but it is kind of like the Republican leadership in Washington trying to distance itself from Mar-A-Lago. Everyone knows who really runs things.

When the January protests erupted—ostensibly over food price inflation and high fuel costs— Tokaev reacted by declaring a state of emergency, issuing “shoot to kill without warning” orders to police, arresting reporters, instituting a complete internet blackout, and asking for intervention by the Collective Security Treaty Organization (CSTO), Russia’s NATO, which sent 4000 troops from Armenia, Kyrgyzstan and Russia to assist in restoring order. By January 13th, Tokaev had arrested some 12,000 union organizers and other civic activists, snuffing out the conflict.

Going back to trying to show a new face for Kazakhstan, Tokaev stripped Nazarbayev of his official rank (although not control of his companies), arrested or executed some of his cronies in the state security apparatus, rolled back gas prices, and restarted the internet. But there is another story here, one which is not being reported.

When neighboring China outlawed cryptocurrency mining overnight last June, many miners —between 60 and 70 percent of Bitcoin’s global mining network—hastily relocated to Kazakhstan, hauling an estimated 87,849 mining machines across the border. By the end of the year. Kazakhstan had become one of the top Bitcoin mining countries, second or third by some accounts. When the internet shut down on January 8, the Bitcoin network lost 12 percent of its hashrate globally. That might have cost Kazakh miners around $20 million, or $4.8 million for every 24 hours with no internet, but the bigger question is, what effect did Bitcoin miners have on causing the protests—and the consequent shutdown—by virtue of the inflationary pressure mining places on energy supply?

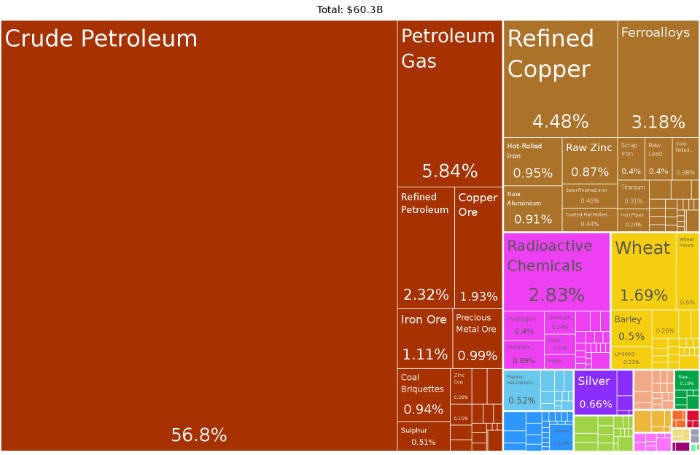

Kazakh exports

Is it a coincidence that cryptocurrencies around the world have added a largely unseen, largely under-reported 7 percent to global money supply and the inflation rate in the United States—highest since the Reagan Recession in 1982—is 7 percent?

When Chinese coinminers plugged their machines into Kazakhstan’s aging power grid it caused a sudden spike in demand for energy. Grappling with blackouts and power cuts, the utilities (owned by Nazarbayev) raised prices. Nazarbayev also jacked up the price of fuel. People shouted “Shal, ket!” and took to the streets.

Meanwhile, for security reasons the miners located their server farms in the remote north, where winter weather brought an unforeseen risk during shutdowns because condensation instantly froze some of the machines, damaging the very expensive hardware. Many Chinese miners had relocated to Southwest Texas this past fall, hoping to cash in on off-peak wind power. Grid reliability in winter there should be equally concerning, but there is a backlog of miners still waiting to plug in as new wind farms go up. Orders for the energy transformers needed to allow Chinese or Russian mining machines to operate in Texas currently have waiting times of six to 12 months.

If the inflation bugaboo being hurled at Joe Biden, weaponized by Fox News with the approval of Mar-A-Lago, brings down the Biden agenda, much as it now threatens to bring down the government of Kazakhstan, what does this say for the stability of countries that are welcoming in BitCoin, such as El Salvador?

Crypto enthusiasts have long forecast the day when fiat currencies are gently put out to pasture, replaced by democratized tokens accepted in free trade, secured by blockchain validation, and incapable of being manipulated by elites to their own ends. Gentle may not accurately describe that change, or “inevitable” describe its viability.

Of course, unless and until it stops drilling oil and gas and mining uranium, Kazakhstan will have a bigger problem than crypto-inflation. The amber plains of grain that underpin its food supply will turn to blowing dust and the hordes that arrive by the millions looking to survive inland after fleeing from rising seas and wildfires will not be golden.

The COVID-19 pandemic has destroyed lives, livelihoods, and economies. But it has not slowed down climate change, which presents an existential threat to all life, humans included. The warnings could not be stronger: temperatures and fires are breaking records, greenhouse gas levels keep climbing, sea level is rising, and natural disasters are upsizing.

As the world confronts the pandemic and emerges into recovery, there is growing recognition that the recovery must be a pathway to a new carbon economy, one that goes beyond zero emissions and runs the industrial carbon cycle backwards — taking CO2 from the atmosphere and ocean, turning it into coal and oil, and burying it in the ground. The triple bottom line of this new economy is antifragility, regeneration, and resilience.

Help me get my blog posted every week. All Patreon donations and Blogger subscriptions are needed and welcomed. You are how we make this happen. Your contributions are being made to Global Village Institute, a tax-deductible 501(c)(3) charity. PowerUp! donors on Patreon get an autographed book off each first press run. Please help if you can.

#RestorationGeneration #Regenerosity

“There are the good tipping points, the tipping points in public consciousness when it comes to addressing this crisis, and I think we are very close to that.”

— Climate Scientist Michael Mann, January 13, 2021.

Want to help make a difference while you shop in the Amazon app, at no extra cost to you? Simply follow the instructions below to select “Global Village Institute” as your charity and activate AmazonSmile in the app. They’ll donate a portion of your eligible purchases to us.

How it works:

1. Open the Amazon app on your phone

2. Select the main menu (=) & tap on “AmazonSmile” within Programs & Features

3. Select “Global Village Institute” as your charity

4. Follow the on-screen instructions to activate AmazonSmile in the mobile app